A new study from Which?, a brand name that promotes consumer choice, is urging banks to prove they can take action to stop people from losing access to cash and valued bank services – or put an immediate pause on bank branch closures until legislation kicks in to protect the fragile cash network.

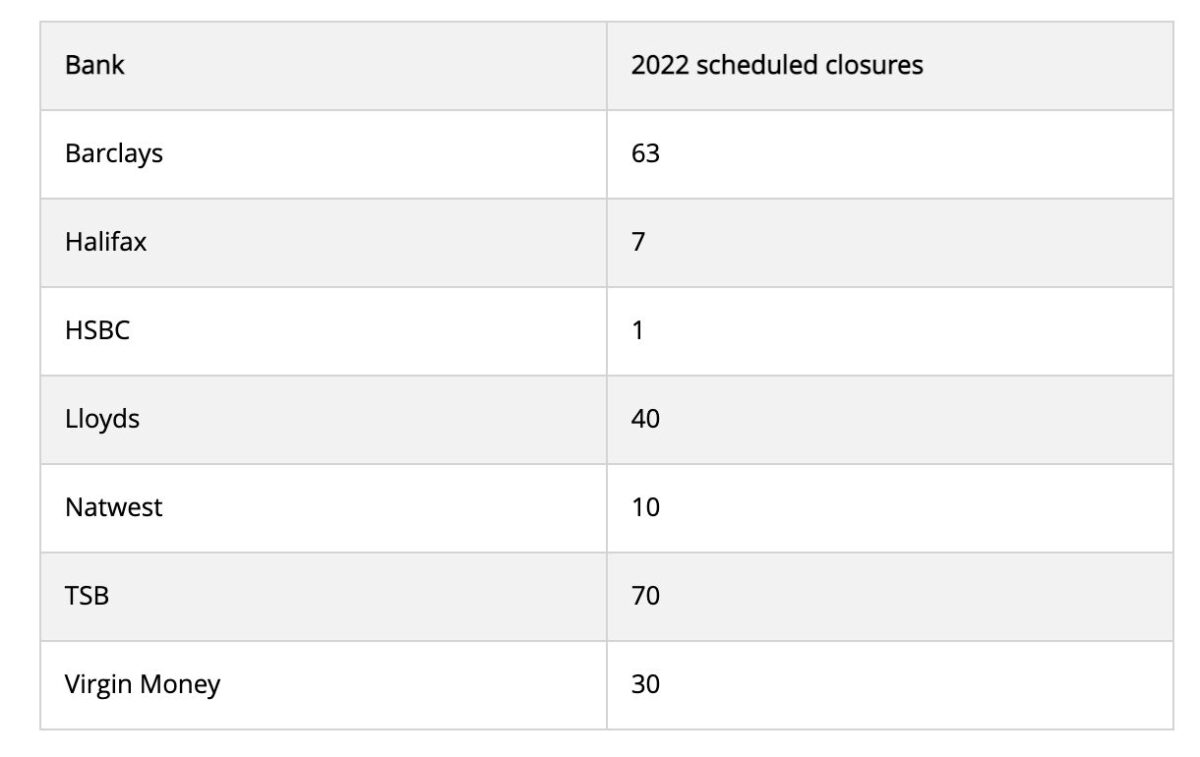

The latest analysis reveals the rate of bank branch closures has surged with 736 branches shutting their doors this year, and over 220 already lined up for closure in 2022. In its response, Which? outlined that it is concerned that banks may be rushing to close branches before solutions to protect vital access to cash can take effect.

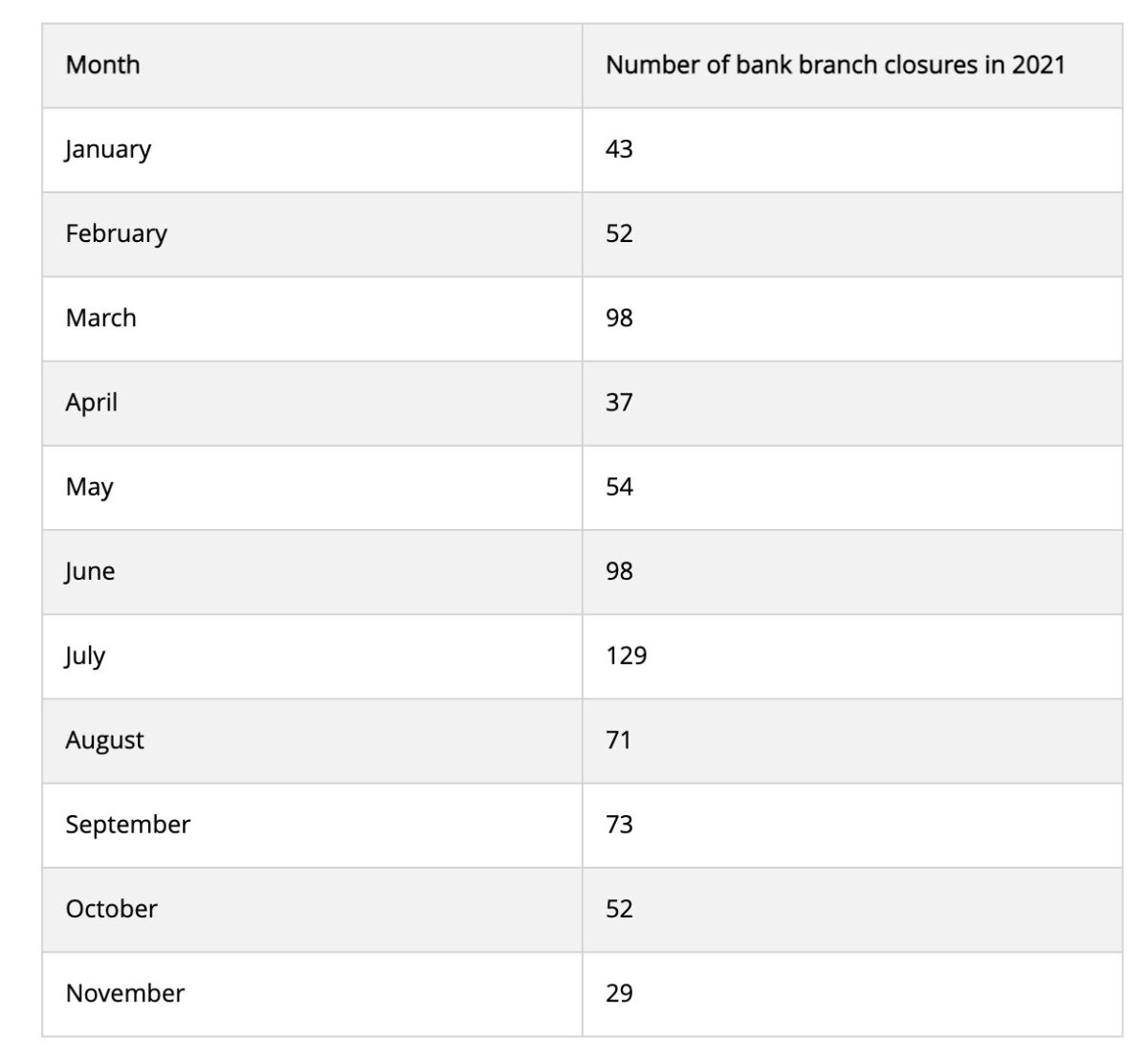

The study said: “Bank branch closures are accelerating Bank branch closures make it harder for people to access their cash for free. Our latest analysis found there have been 736 branch closures this year – an average of 61 a month. This represents a 17% rise compared to the rate of closures in the previous six years when an average of 52 branches were closing a month. The table below sets out the number of branches that have shut their doors each month this year. You’ll see 2021 closures peaked in the summer when a staggering 298 closed between June and August – an average of 99 per month.”

The most recent figures from UK Finance, the banking association, show two-thirds of adults (72%) used online banking and over half (54%) used mobile banking in 2020. However, there are still plenty of people and small businesses that rely on local banks and the services they offer.

The most recent figures from UK Finance, the banking association, show two-thirds of adults (72%) used online banking and over half (54%) used mobile banking in 2020. However, there are still plenty of people and small businesses that rely on local banks and the services they offer.

Krista Griggs, Head of Financial Services and Insurance at Fujitsu, said: “The shrinking number of bank branches has become commonplace for some time now but Covid has accelerated this trend. When banks closed their physical doors for prolonged periods, customers had no choice but to switch their physical wallets to digital wallets; the rise in online shopping and increased contactless payment limit certainly aided this. What we’re now beginning to see is the aftermath of this digital shift.

“Brick and mortar banks were once the heart of the high-street, and while a cashless society is deemed progressive, removing ATMs and traditional banks will impact the most vulnerable in society. Adults who are digitally excluded are nearly 5 times more likely than the UK average to rely on cash to make their payments. Similarly, regional variations must be considered as infrastructure still lags in rural areas. For instance, for all of the potential that 5G connection brings it is only largely available in cities such as London.

“Yes, the disappearance of banks may be an inevitable progression in society. But, the industry must make sure there is a level playing field for everyone. Banks, governments and businesses alike must ensure that customers have access to their services – failure to do so could cause a widening in the socioeconomic climate.”

UK Finance’s Access to Cash Action Group (CAG) is set to outline measures to address the country’s access to cash crisis. Specifically that whenever a decision to close a bank branch is made:

- an independent assessment is undertaken of the impacted community’s cash needs;

- a summary of this assessment is made public to ensure transparency and accountability;

- and seamless access to the most appropriate type of provision is put in place to ensure that there is no gap in provision for those who need it, particularly the elderly and vulnerable.

If banks cannot meet these commitments, then both the CAG and Which? believe the bank involved should pause their branch closures until they can or until legislation to protect access to cash has been rolled out. While the UK Government had opened consultations on the issue, it has been slow to publish any findings.

Anabel Hoult, Which? Chief Executive, said: “The alarming acceleration of bank branch closures has left many people who depend on them for essential banking services at risk of being cut adrift, which seems to fly in the face of work being done across the industry to protect access to cash.

“While many people can now bank digitally, millions of people are not yet ready or able to do so. Greater scrutiny of branch closures must be in place to ensure that people who rely on cash can access it.

“We are calling on banks to pause any programme of branch closures until proposals to protect access to cash are rolled out. The government must also urgently press ahead with long-promised legislation that guarantees consumers can continue to access cash for as long as it is needed.: