Second debit card available to personal account holders

Connected card can be given to trusted helpers purchasing essential items for those self-isolating

Spend what you choose to make available with a maximum balance of £200

Second card limit to be managed via the Starling app

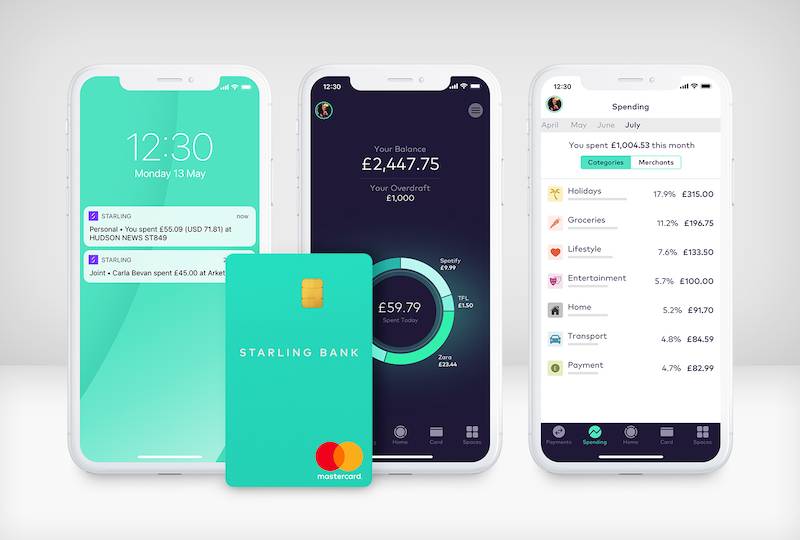

Starling Bank is introducing the Connected card, a second card that customers can connect to their existing account and give to anyone they trust to pay for groceries and other essential items on their behalf.

The Connected card has been designed to help personal account customers who are self-isolating during the coronavirus emergency and are relying on trusted friends, neighbours and community volunteers to get their shopping in. The cards avoid the need for IOUs, cash, contact, cheques or the exchange of sort codes and account numbers.

Protected by a PIN and with a balance limit of £200, the Connected card is secure and only permits users to spend in-store and not online. This gives the account holder control over their money when they’re unable to visit the shops themselves.

Anne Boden, founder and CEO of Starling Bank said: “We know that getting in groceries and other essential items is a challenge for those who are self-isolating during the coronavirus emergency. So we came up with a solution to help our customers pay for supplies bought for them by trusted friends and neighbours without the hassle of transferring money or handling cash.

“Together with mobile cheque deposits, which we launched earlier this week, we’re working hard to help our customers at this difficult time.”

Personal account customers can apply for a Connected card on their Starling Bank app, and the card will be delivered to their registered address in 3-5 working days.