A fresh report by Silicon Valley Bank (SVB) has provided an insight into another booming year for the fintech industry. The report explores the current state of the fintech landscape including a view into investments by geography, fintech sectors, exits and revenue as well as a spotlight on payment facilitation.

2021 has set many records for fintech. It’s been a year full of promising investments and fruitful partnerships, and as the report highlights, the popularity and functionality of crypto and blockchain continue to climb. Here’s what you need to know from the report:

Fintech Opportunities Are on the Rise

Venture capital (VC) investment in fintech companies reached a new high in 2021, surpassing the previous record set in 2020 of $166billion. The consumer and business shift toward digital brought about by the pandemic has buoyed interest in fintech startups. In 2021, fintech companies were 14 per cent of all VC deals but accounted for 18 per cent of investment.

Fintech Excites Corporate VCs

The number of CVC fintech deals is on track to increase 64 per cent over 2020 with an aggregate deal size projected to increase 158 per cent.

Valuations and deals are also on the rise, which has resulted in European and American fintech companies raising a combined $70billion in 2021 (up from $29.3billion in 2020).

Emerging Opportunities in Fintech

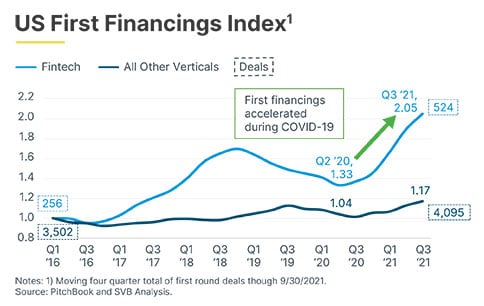

An increase in digital users has broadened the market, leading to a surge in fintech company formations. Since Q2 2020, first financings for fintech startups have jumped 53.6 per cent reversing the pre-pandemic downtrend. Cryptocurrency and blockchain is quickly becoming the fastest-growing fintech sector at both early and late-stage due to investors betting that new technologies will usher in a future decentralised financial system.

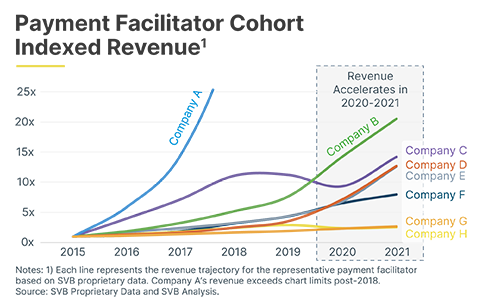

More Companies Across Verticals Integrating Payment Facilitation Models

With new payment facilitation solutions continuing to remove hurdles for merchants looking to process digital payments, revenue for PayFacs has accelerated since the start of the pandemic with no signs of slowing down. Payment facilitation is emerging as one of the largest growth opportunities for companies in non-financial industries such as retail, logistics, car manufacturing and food services

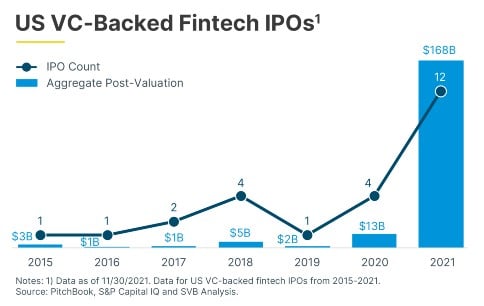

Fintech Dominates the IPO Market This Year With 12 Companies Going Public

With positive investor sentiment for high-growth fintech assets combined with a willingness to pay a premium, fintech companies accounted for five of the 10 largest US VC-backed tech IPOs in 2021.