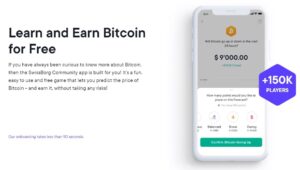

The SwissBorg Community app introduces people to crypto-assets, this educational gaming app lets members predict the price of Bitcoin, and earn it, without taking any risks. The use of responsible gamification adds an element of fun, with more points earned, the higher the rank and chance to win tokens. The app provides the players with a daily Bitcoin analysis, educational articles and videos as well as the latest trends and news of the crypto market.

SwissBorg co-founders Anthony Lesoismier and Cyrus Fazel outline their vision of decentralising finance and making wealth management accessible to everyone

After years of working in traditional banking and asset management, Cyrus Fazel and Anthony Lesoismier were ready for a change. In 2017, they established Swissborg with a mission to revolutionise personal finance by building products that would allow individuals – from novices to seasoned investors – to easily manage crypto assets wherever they are in the world.

SwissBorg, with its headquarters in Switzerland and offices in Tallinn, Toronto and London, is not just another trading platform, but rather a unique community-centric financial ecosystem that ultimately allows individuals to control their own wealth.

“When we look back at our time in banking, we were making good money, we had beautiful business cards with titles, but what we were and what we were doing didn’t feel like real life and there was a lack of alignment for us,” explains Anthony Lesoismier, chief security officer and co-founder of SwissBorg. “We’re not saying that the financial world itself is bad as there are many things that are extremely good. But we wanted to create something different with much more life, and what we are doing now is all about improving the financial world. We try and enthuse and encapsulate every innovation that is out there and makes it available for adoption.”

In 2018, the company successfully ran one of the first decentralised referendums on the Ethereum blockchain, allowing its growing community to vote on the team’s projects. A second referendum allowed community members to vote on the sector they would first like to engage in an initial coin offerings (ICO) mentoring programme. This led to one of the 12 most successful ICOs in Switzerland in 2018.

At the core of the SwissBorg offering are their three main products of CHSB Token, the community app and the wealth app.

The CHSB token is multi-utility Ethereum token (ERC20) that can be used in various ways within the SwissBorg ecosystem, including voting rights, rewards and staking for zero percent commission.

The SwissBorg Community app is a fantastic way to introduce people to crypto-assets, this educational gaming app lets members predict the price of Bitcoin, and earn it, without taking any risks. The more points earned, the higher the rank and chance to win tokens. The app provides the players with a daily Bitcoin analysis, educational articles and videos as well as the latest trends and news of the crypto market.

SwissBorg’s crypto wealth management app (wealth app) lets users securely exchange digital assets and invest with fiat currencies, with the protection of MPC keyless technology.

SwissBorg’s crypto wealth management app (wealth app) lets users securely exchange digital assets and invest with fiat currencies, with the protection of MPC keyless technology.

November 2020 proved to be a particularly successful month for SwissBorg with several milestones reached. It now has more than 62,000 people using its Wealth App and 80 million assets under management. While, its Community App has entertained more than 150,000 users with tips on Bitcoin investing.

“While many companies claim to be community-centric, this can often just be a marketing ploy,” says Lesoismier, who suggests that buying Bitcoin from a company, such as Coinbase, that has a centralised corporate structure and charges high fees, is not really a commitment to an alternative financial system. For SwissBorg, the future of finance is about collaboration and space where people come together to solve problems.

“If you are building electric cars because you believe the planet deserves better and you want to use sustainable energy, then the manufacturer you choose and the way they build the car should be aligned with that,” says Lesoismier. “If you’re using all the non-renewable energy to do that, then there is a misalignment. For us, we are more than just a marketing claim, we want to do better. In finance, we want to help anyone get access to deals that are offered in the crypto world and achieve a more equitable future.”

The newest product to launch is the Smart Yield account, which uses artificial intelligence to provide the best investment opportunities on a daily basis. Because the decentralised finance (DeFi) world is complex, risky and often costly, the aim is to simplify this by automatically connecting to reliable projects with the highest yield, mitigating risk.

Cyrus Fazel, co-founder and CEO of SwissBorg, explains: “The next big thing we are going to provide very soon is a robo adviser that enables you to have yields and interest rates on different cryptos. For us, that is really a massive move. When you buy Bitcoins you need to have a certain amount of risk appetite, as it is a very volatile instrument. However, the yielding process is for anyone.”

“In the new DeFi role, there are essentially different lending and borrowing platforms where you could lend, or you could borrow and by doing that you get different yields. Our robo advisor manages to get the best out of this – it looks at all these platforms to do a kind of credit rating like Moody’s, but by looking at all the different blockchain decentralised financial applications that exist today.”

“It’s actually a really tough job, probably even harder than Moody’s, because here what we’re looking at in terms of risk is not only the corporate risk that you have or the liabilities of the company, but also the technical side of it, how is it being run, if there’s any loopholes or if auditing has been well done or not. We have an investment universe with different counterparties that we update on a weekly basis and we scan this investment universe for different options of yielding.”

In that respect, SwissBorg sees itself as a bridge between DeFi and centralised finance (CeFi), with both DeFi and CeFi have valid places in the cryptocurrency movement, they offer attractive yields, faster transactions, and infrastructure that promotes more open finance.

Fazel says: “We have moved from trading assistance, which was our first model and was built on buying low and selling high with our Smart Engine. Data enables you to build your confidence of buying or selling. Now we are offering a semi-automatic experience – you don’t need to know how to drive the car as we will drive it for you and hopefully provide a better investment experience.”