Fair Finances is a self-generated project by Plot London, and kindly supported by the Paul Hamlyn Foundation. We are using design and technology to radically re-think financial services and make them simpler and fairer for the most vulnerable.

Fair Finances is a self-generated project by Plot London, and kindly supported by the Paul Hamlyn Foundation. We are using design and technology to radically re-think financial services and make them simpler and fairer for the most vulnerable.

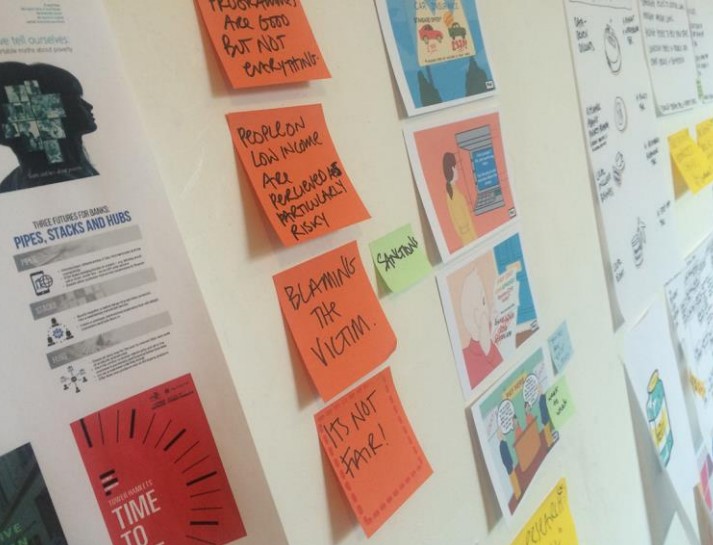

Our latest round of work builds on previous months’ of reviews and research, available on a public Evernote page and summarized in an article in The Fintech Times, and has now resulted in four very different prototypes. These prototypes are being made in order to explore the potential for a fairer, more inclusive and less disabling kind of financial environment in which people experiencing poverty do not continue to be punished just for being poor.

There has been lots of great research and useful initiatives underway but yet it feels that not much changes it does feel. Therefore we’re focused on making this conversation an effective one. During the process we have had the opportunity to connect with Toynbee Hall, Bromley by Bow Centre, Salford Poverty Truth, Joseph Rowntree Foundation in the UK and FAIR Money in the US. Our aim is to situate prototyping as a form of action and as a complement to just writing reports. We want these prototypes to highlight the issues, think outside of the conventional paths, and explore the possibility of connecting individuals and local organizations to a wider pool of social capital. Technology combined with service design is a powerful opportunity to explore financial inclusion and make a positive impact. Rooting the process in customer needs and validating it through cycles of live action research, feedback and iteration is key.

Our success criteria for the whole Fair Finances project includes: generating plenty of noise about this work; an increase in stakeholders wishing to be involved and ideally a financial or organisational interest in helping to take the prototypes further.

Below is how the four prototypes are shaping up and what we’d like to see as the next steps.

1. Anti Poverty Premium Kitemark

Charging extra to the least resourced in our communities seems to be widely accepted as an appropriate business strategy. Yet the evidence of the harm this creates is well-documented by Toynbee Hall and Joseph Rowntree Foundation. You could see this as normal. Or you could see this as a market failure. And in any market failure is an opportunity to do things differently. Alternative business models, such as freemium, Robin Hood or tiered service become possible. So we’re asking What might trigger companies to establish a kitemark system that becomes the vanguard for a commercial movement against the poverty premium? What are the conditions that could stimulate and encourage this kind of initiative. We’ve started mapping out what the system might look like.

What happens next? Plot and the Fair Finances team will identify specific businesses, share the idea and gauge their interest.

2. Data Discounts

Data from our transactions informs companies if we are good for credit and contracts. The way this currently operates excludes many people from existing financial products, or even engaging with financial service providers. What if we could invert the model and find a way to harness the data that people who have little generate? Or use alternative forms of data to create a different kind of score, perhaps a trust score.

What happens next? We’ll be pinpointing providers that could bring these data services to consumers and examining the kinds of discounted and supporting services might be designed as a result.

3. Business giveback kit

Social capital extends the reach of people into help and support and in a neighborhood it creates trust and local economic resilience in troubled times. People experiencing poverty can be challenged by a lack of social capital. What might it take for small, local, independent businesses to give something back in their neighborhood? How might they do that in a way that works for them? Our kit, which is out for testing right now aims to help small business owners (perhaps with their staff) explore what and how to give to local people who really need it. With examples of other successful schemes, the kit gives them a process for decision-making, so that they can consider what they can do. Then they can establish how not to over-stretch themselves. Finally they can work out a non-stigmatizing way of making sure the right people know what’s available.

What happens next? We’re looking for possible sponsors of the kit. And we want to collaborate with a partner capture the data and evaluate the benefits created by the kit.

Much of the great research shows that people can be pushed into a spiral of poverty after minor events. These everyday events are common, such as a washing machine breaking down, or simply starting a new job. We conducted some research locally into how people feel about having a local emergency fund they contribute to. We are prototyping how this might work next.

What happens next? We’d like to establish who the best partner would be; maybe it’s a credit union? And we’re open to hearing lots of ideas for where could be a good place to host the fund.

To follow our progress check out the project blog at www.plotlondon.net/fairfinances

On social media: #fairfinances #timeforfairfinances #povertypredator

And feel free to get in touch directly with Plot